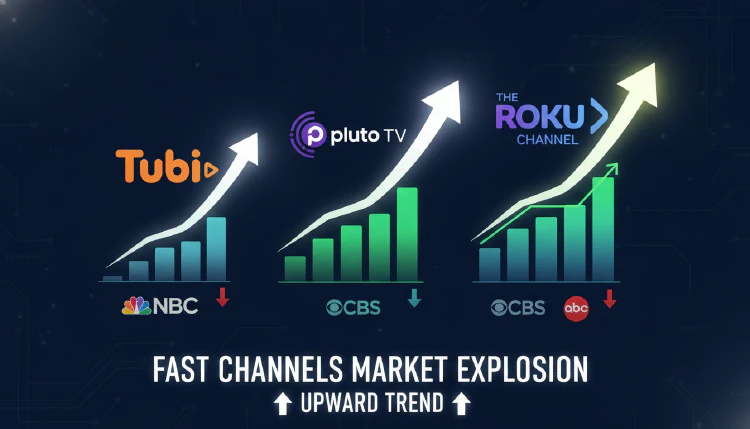

Free Streaming Is Booming: FAST Channels Surpass Broadcast Networks in Viewership

While the headlines often focus on subscription streaming services like Netflix and Disney+, a quieter revolution has been unfolding in free streaming. Free Ad-Supported Streaming TV (FAST) channels have grown from a niche curiosity to a major force in the entertainment landscape.

The Numbers Are Remarkable

The top three FAST platforms — The Roku Channel, Pluto TV, and Tubi — now collectively account for 5.7% of all TV viewing in the U.S. as of May 2025. That’s more than any single broadcast network commands.

Adwave reports that 45% of U.S. internet households now regularly watch FAST services — a dramatic jump from just 30% in 2022. The FAST market is expected to reach $12.26 billion in 2025 and grow to $27.14 billion by 2030, according to Mordor Intelligence.

Tubi: The Breakout Star

The biggest success story in FAST is Tubi. CNBC reports that by Q4 2025, Tubi commanded 6.2% of all ad-supported streaming viewing, placing it ahead of platforms like Netflix’s ad tier and Peacock in that category. Fox reported that Tubi reached profitability for the first time in the fiscal quarter ended September 30, 2025 — “earlier than expected,” according to Fox CEO Lachlan Murdoch.

The FAST Channel Explosion

According to Unified Streaming, the number of active FAST channels has nearly doubled since mid-2023, reaching over 1,610 channels across key markets including the U.S., U.K., Germany, and Canada. Globally, Gracenote Video Data counts over 1,900 individual FAST channels.

The fastest-growing content categories in FAST are:

- Reality: Growing 626% from 19 to 138 channels since July 2024

- Sports: Increasingly available on free platforms

- News/Commentary: Building dedicated channel audiences

Why FAST Is Growing

Cord-Cutting Economics

As traditional cable bills rise and households cut the cord, FAST channels fill the gap for live, linear programming — the channel-surfing experience that many viewers still enjoy.

Subscription Fatigue

With so many paid streaming services competing for wallet share, free alternatives are increasingly attractive. Many viewers maintain 1-2 paid subscriptions and supplement with FAST channels.

Quality Content

FAST channels are no longer limited to B-list content. Major studios are licensing popular library titles to FAST platforms, and original FAST-exclusive programming is growing.

FAST vs. Paid Streaming

Adwave’s comparison shows that free streaming continues to gain ground against paid services. The key differentiator: FAST channels offer a lean-back, linear viewing experience similar to traditional TV, while paid services focus on on-demand catalogs.

What It Means

The growth of FAST channels validates a simple truth: consumers value free content, and advertisers are willing to pay to reach these viewers. For the broader streaming industry, FAST represents both an opportunity (new ad revenue) and a challenge (competition for viewer attention).

Sources: